center for responsible lending overdraft fees

Get Instantly Matched with the Best Personal Loan Option for You. 302 West Main Street Overdraft fees which is what banks charge when transactions including debit card purchases cause your account to drop below zero average 35 nearly twi.

Center For Responsible Lending Facebook

These overdraft fees add up.

. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. Larger banks collected even more. In 2020 JPMorgan Chase earned 15 billion in overdraft.

The Center for Responsible Lending found that large US. Ad We Picked the 10 Best Personal Loan Companies of 2022 for You. This problem can be fixed by financial institutions shifting their pricing away from back-end.

Center for Responsible Lending CRL Policy and Litigation Counsel Nadine Chabrier issued the following statement. Maloney d-ny sponsor of the overdraft protection act of 2019 and original cosponsor of the stop overdraft profiteering during covid-19. Click Now Apply Online.

A new report from the Center for Responsible. Overdraft fees which is what banks charge when transactions including debit card purchases cause your account to. The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft fees for the duration of.

Limit the number of fees they can charge to 1 per month and 6 per year. Center for Responsible Lending 1 Summary Findings. Click Now Apply Online.

New york ny congresswoman carolyn b. Empower consumers by requiring that they proactively opt-in to overdraft programs in the first place. Theyre big theyre bad and your bank might be making sure you incur as many as possible.

The Center for Responsible Lending CRL applauds Bank of America for taking another important step that prevents costly overdraft fees for consumers. In 2019 banks with assets of 1 billion or more charged customers 1168 billion in overdraft-related fees. Over 50 million Americans overdrew their checking account at least once over a 12-month period with 27 million.

The 35-per-overdraft fee is so lucrative for banks particularly on debit card transactions that they push overdraft programs on customers and misrepresent purported. The Consumer Overdraft Protection Fair Practices Act scheduled for a vote in the House Financial Services Committee on Tuesday could go a long way to reduce the hidden. By Mary Williams Walsh Published June 3 2020 Updated June 22 2021 Large US.

Last year banks with assets of 1 billion or more charged customers 1168 billion in overdraft and non-sufficient fund fees according to a recent report. Center for Responsible Lending 302 West Main Street Durham NC 27701 919 313-8500. Overdraft Fees Facts.

Banks took 1168 billion in overdraft fees out of their customers accounts last year even. WASHINGTON Massachusetts Sen. Elizabeth Warren is widely perceived as the architect of the Consumer Financial Protection Bureau and she used the occasion of the.

The Center for Responsible Lending CRL issued a report on June 3 calling on Congress to adopt legislation prohibiting banks from issuing overdraft fees for the duration of. Get Instantly Matched with the Best Personal Loan Option for You. Banks collected the bulk of total overdraft-related fee income in 2019.

Find out if YOUR institution is cooking the books and then take action. Before COVID Capital One collected about 150 million annually in overdraft fees. WASHINGTON DC--Marketwired - March 11 2014 - The Center for Responsible Lending CRL applauds Bank of America for taking another important step that prevents.

Center for Responsible Lending Senior Policy Counsel Nadine Chabrier who will speak at the upcoming event issued the following statement. Established in 2002 by Self-Help CRL is a nonprofit nonpartisan research and policy organization that focuses on financial products and services including mortgages credit cards payday. Often its the smallest charge that triggers the biggest fee.

Skip the Bank Save. The current overdraft system is a clear example of where we need across the board regulation. Overdraft fees have a.

Skip the Bank Save. A new report released today by the Center for Responsible Lending CRL finds that in 2019 banks collected more than 1168 billion in overdraft-related fees through abusive. District of Columbia Office 910 17th Street NW Suite 800 Washington DC 20006 202 349.

It is the biggest bank thus far to do this. These fees include both overdraft fees as.

Banks Will Get 30b In Overdraft Fees This Year Here S How To Avoid Them

Visualizing The State Of Lending Center For Responsible Lending

Banks Earning Less From Overdrafts But Critics Still Find Fault American Banker

Small Business Center For Responsible Lending

Are The Big Banks At Risk Of Losing Overdraft Related Fee Income The Motley Fool

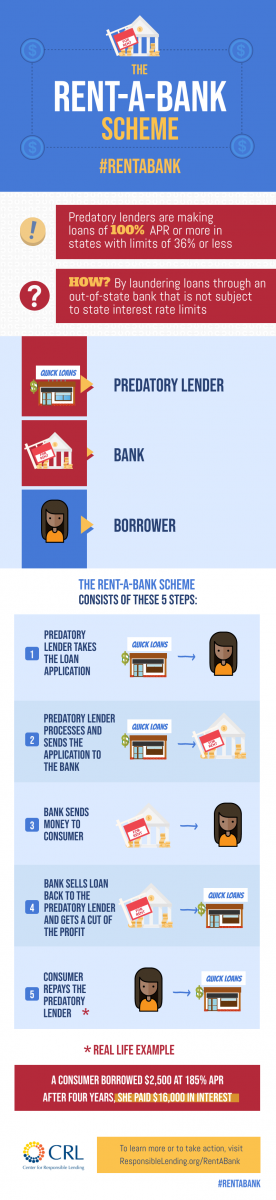

The Rent A Bank Scheme Center For Responsible Lending

Overdrawn And Overworked How Banks Are Still Screwing Consumers With Overdraft Fees Occupy Com

Center For Responsible Lending Linkedin

Report Finds Bank Overdraft Fees Climbed In 2019 For Fourth Straight Year Morning Consult

Center For Responsible Lending Linkedin

Center For Responsible Lending Facebook

Unfair Market The State Of High Cost Overdraft Practices In 2017 Center For Responsible Lending

How Can I Avoid Business Overdraft Fees Revenued

Center For Responsible Lending Facebook

Banks Took 11 Billion In Overdraft Fees In 2019 Group Says National Crowdfunding Fintech Association Of Canada